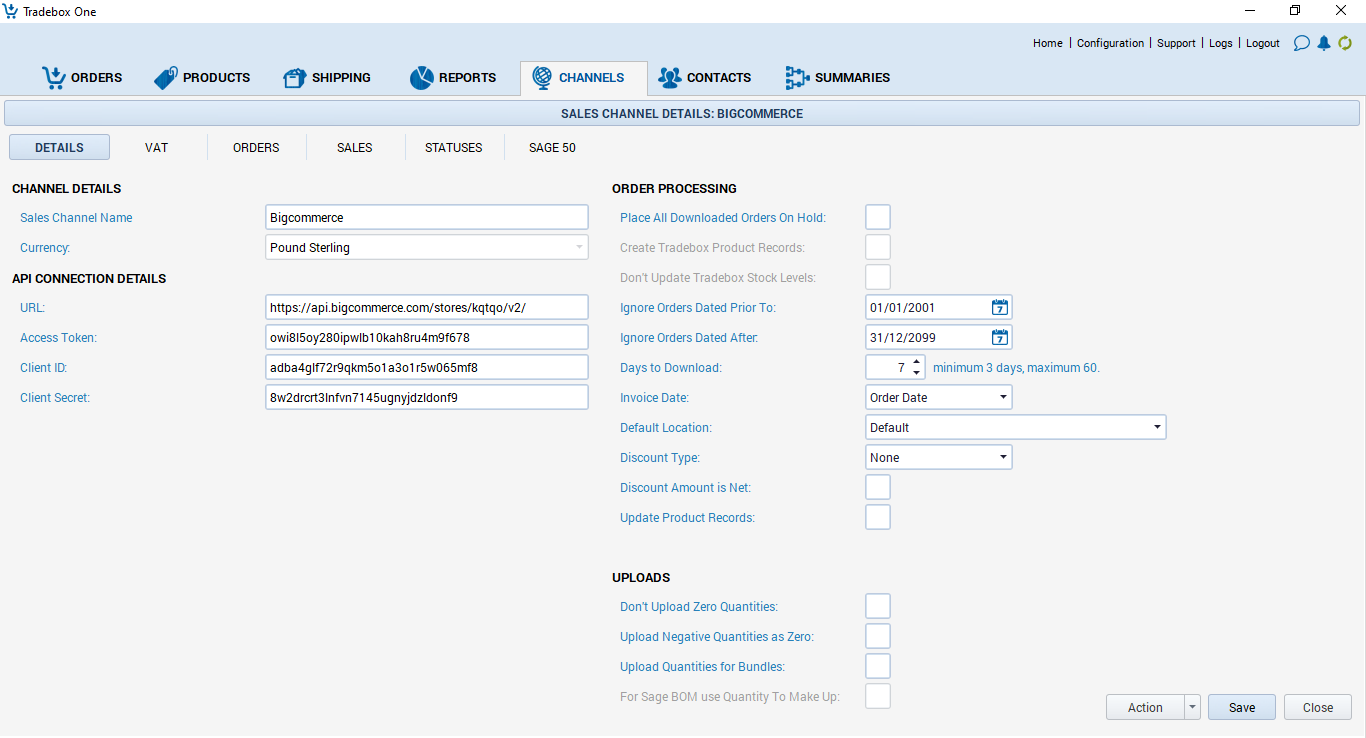

The channel module in Tradebox One contains a list of all of the external sales channels Tradebox is integrated with. To access the channel configuration settings go to Channels and double-click on the channel from the list. The channel is split into 6 tabs:

- DETAILS - Channel integration and configuration settings

- VAT - Tradebox's VAT settings

- ORDERS - A list of orders downloaded through this channel

- SALES - Graph comparing last 3 calendar year's sales

- STATUSES - Map marketplace statuses to Tradebox statuses

- SAGE 50/XERO - Settings for accounts integration

There is a save button at the bottom of each tab. Clicking this saves and closes down the channel details and takes you back to the channel list. If you are amending multiple tabs at once, you can navigate between the tabs without saving. It's only necessary to click the save button once you've made all your amendments in every screen.

Details

Channel Details

Name: The name given to the sales channel to identify it. This is a free text field. It is recommended that the name is something that easily identifies the channel Tradebox is integrated with. This field is editable.

Currency: Displays the currency of the channel. This field cannot be changed once it has been established. A Tradebox channel can only import sales that have a matching currency, if you take orders in multiple currencies on Bigcommerce you'll need multiple sales channels in Tradebox to handle those.

API Connection Details

This section displays the API credentials used during setup. You'd only need to change these if your Bigcommerce store URL changes or if you delete and recreate the API credentials. More in-depth details can be found in the BigCommerce API Credentials article.

Order Processing

- Place all downloaded orders on hold: If ticked, all orders downloaded by Tradebox are assigned an On Hold order status. When an order is in this status, the order cannot be marked as shipped or passed to an accounts package. Effectively the order is frozen until a user changes its status.

- Create Tradebox Product Records: This option is not applicable and will be hidden if you have chosen to run stock control in your accounts package, or no stock control. If ticked, Tradebox will create new products in the Product Module where a SKU in a downloaded order does not already exist. The product record created will only contain the minimum information required such as SKU and description, and will use your default tax code.

- Don't Update Tradebox Stock Levels: This option is not applicable and will be hidden if you have chosen to run stock control in your accounts package, or no stock control. If ticked, Tradebox will not amend stock levels in its own database based on orders received through this channel. To be used, for example, if you don't store your own stock for this channel.

- Ignore Orders Dated Prior To: Allows the user to configure Tradebox to ignore any transactions prior to a given date preventing orders that fall before this date from being downloaded.

- Ignore Orders Dated After: Allows the user to download orders up to a certain date and prevent any orders downloading after that date. This would usually be used where certain settings would apply up to a specific date, and different settings after that date, for example, the date you become VAT registered.

- Days To Download: How many days worth of sales you want Tradebox to download for this particular channel. Tradebox will never download any duplicate sales, but it can cover old ground to see if any orders that didn't meet your criteria on first check are now valid for download, and also update order statuses if applicable. Each cycle of the service loop will take noticeably longer if this is set to a high value for Amazon channels, it also increases the potential of Amazon's API throttling requests.

-

Invoice Date: applies only to invoices generated within Tradebox, not within an accounts package. Choose from:

- Order Date - The date the order was placed

- Payment Date - The date the order was paid for

- Despatched Date - The date the order was despatched

By default, this option is set to Order Date. Payment Date and Despatched Date can only be used if they are provided by your site and the order is downloaded at a stage when they are populated.

- Discount Type: choose the type of discounts in use on your Bigcommerce store, if any. This will inform how the order amounts are calculated in Tradebox. Choose from:

- None - No discounts to be applied

- Order Discount - This applies a discount off the entire order. Each item will show it's full selling price and you'll see an additional negative item line to represent the discount.

- Item Line - This applies a discount per item, shown on the relevant item lines of the order.

- Discount Amount is Net: Should be ticked if the discounts provided by your Bigcommerce site are a net value rather than a gross (inc. VAT) value.

- Update Product Records: A listing ID is required for stock upload to Bigcommerce. If ticked, Tradebox will automatically download listing ID's as part of the service loop for products that have a valid mapping.

Uploads

These options apply to Tradebox's upload of free stock quantities to your marketplace. Not all users use the upload routine. Please see our Uploading Stock Levels guide for more information.

- Don't Upload Zero Quantities: Tradebox will not upload a stock level of zero to any item on Bigcommerce.

- Upload Negative Quantities as Zero: If a stock level is negative, Tradebox will convert the stock level to zero instead.

- Upload Quantities for Bundles: Bundle products in Tradebox are by default excluded from uploads. Ticking this box will include them.

- For Sage BOM use Quantity to Make Up: If you're using Sage stock control and have BOM (Bill Of Materials) products, Tradebox can calculate the number of BOM end products that can be made up from the component products, and upload that to Bigcommerce.

VAT

The VAT section of the channel details shows a set of default tax codes for UK and Rest of World. The illustration above shows the default codes for a business on the standard VAT scheme. The UK Sales dropdown only applies to users who are running without any stock control; if you are using stock control in either Tradebox or an accounts package, Tradebox will automatically use the tax code on the product record and the UK sales options will be greyed out.

Use Product Tax for Carriage: If you are selling goods with a mixture of tax codes, you may wish to select this option. With this setting turned on, if all of the products on an order are non-vatable, then no VAT will be applied to the carriage. If any product on the order is standard rated then the carriage will also be standard rated, even if the majority of the products are non-vatable.

Use Single Tax Code for ALL Entries: If ticked, all sales and carriage through the channel will use the code you choose from the dropdown that appears. This takes precedence over all other VAT settings except the per-customer tax code within the Contacts screen.

EU VAT Calculation Method

For EU sales, there are four options you can choose from.

1. Remove Destination VAT - Zero Rate: When this option is selected, Tradebox takes the total value of the sale from your website and applies a zero rated tax code to it.

2. Calculate Destination VAT on orders less than €150: To be used where you are liable for VAT on EU orders up to a value of €150. This will instruct Tradebox to check the tax rates you have applied against each EU country in Configuration > Countries within Tradebox. The tax rate will be determined based on the standard rate of the country the order is being shipped to, or the product tax for that country.

3. Calculate Destination VAT on All Orders: This is used if you are liable for VAT on all EU orders, regardless of their value. The tax rate will be determined based on the standard rate of the country the order is being shipped to, or the product tax for that country.

4. Zero Rate Gross Value: With this option, Tradebox simply takes the total value from the website and applies a zero rate tax code to it. When this option is selected, a secondary option becomes available which allows you to choose which of your zero rated tax codes you want to use for these sales.

For more details on how Tradebox deals with VAT, see our article here.

Orders

The orders section of the channel will display all orders that have been downloaded for that particular channel. It displays the following information:

Type: Displays either SO (Sales Order) or SC (Sales Credit Note).

Date: The order date. By default, this is the date the order was placed.

No. The Tradebox order number, which is automatically assigned on download.

Channel No. The order number from the channel, in this case, the Amazon order number.

Customer: The customer's name.

Value: The total value of the order.

Status: The order status within Tradebox.

Double clicking on any order in the grid opens the order in full. The grid can be sorted by any column and is sorted by order date by default.

Sales

The Sales page of the channel details shows a breakdown of the sales value for this channel by month over the past three years, with the option to view as a bar graph or line chart.

Statuses

The top section of the Statuses tab displays a list of marketplace order statuses and the corresponding Tradebox order statuses they are mapped to. This controls at which status your orders will download to Tradebox. The bottom section of the grid controls which statuses are set to post to your accounts package (if integrated). To edit a marketplace status, select edit or double click on it and a pop up box will appear that allows you to choose what Tradebox status to map it to, and whether you want that status to download. To edit a Tradebox status, select edit or double click on it and a pop up box will appear that will allow you to choose whether or not you want orders with that status to post to your accounts. You can add or delete marketplace statuses using the Statuses - Add New and Statuses - Delete functions in the Action menu in the bottom right.

Click here for a more detailed guide to order statuses.

Sage 50/Xero

If you have opted to link Tradebox to an accounts package, you will see either Sage 50 or Xero displayed as an additional tab within the channel. This holds the connection details for your accounts package, and, once connected a new range of tabs will open up. The Sage 50 connection page is shown below:

For full instructions on setting up the accounts link, see the relevant guide:

To set up a Sage 50 accounts link click here or to set up a Xero accounts link click here.

Comments

0 comments

Article is closed for comments.