When selling abroad, there may be situations where products that you sell require a VAT treatment other than the standard rate for that country. For example, if you are selling children's clothes to the EU, they may be zero or reduced rate within a specific country.

In order for Tradebox to determine the tax rate correctly, those tax rates will need to be set up in the Tax Rates section of Tradebox and then allocated to the product records within Tradebox itself.

Tax Codes can be added to individual products or this can be done in bulk by using a CSV import.

Adding Tax Codes to Products Individually

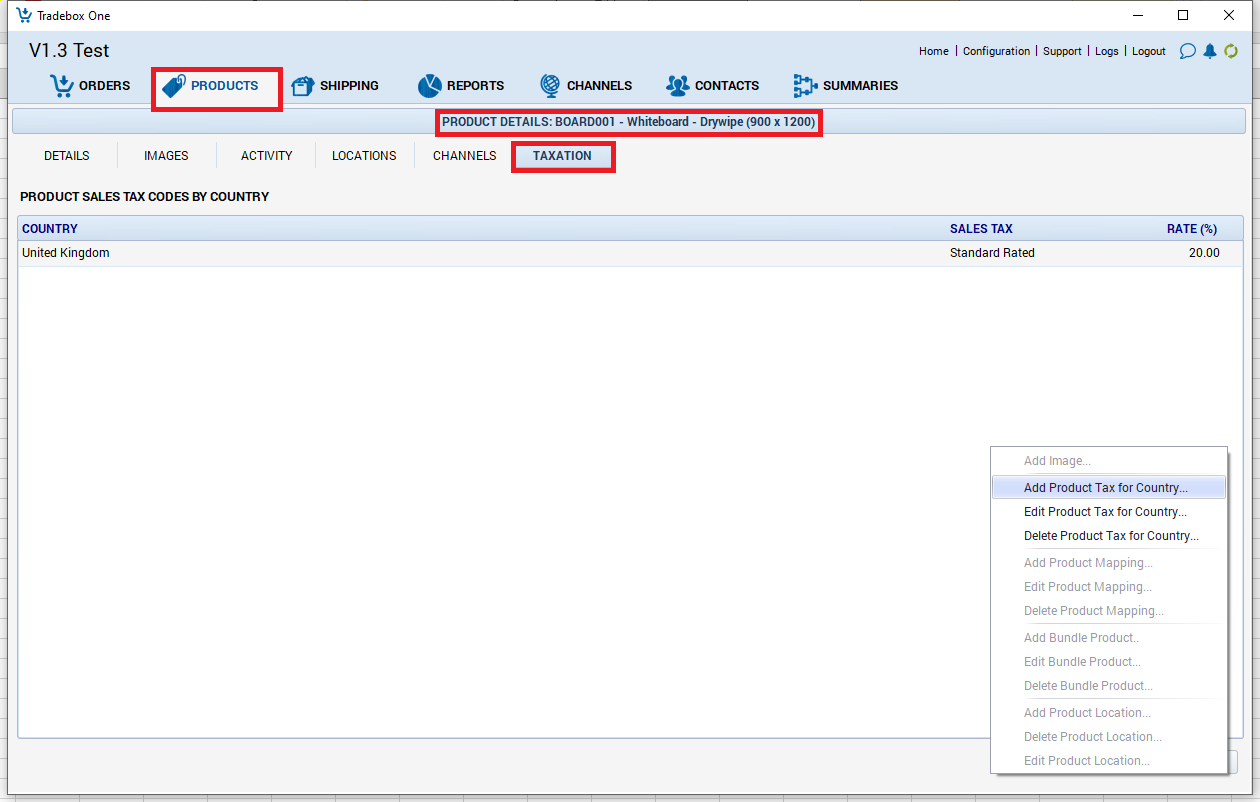

To add tax codes individually to products in Tradebox, go to the Products module and double click on the product then go to the Taxation Tab. From the Actions button at the bottom of the screen select Add Product Tax for Country:

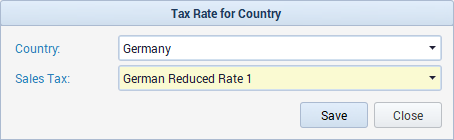

From the prompt box add the Country and the Reduced Tax Rate that has been created in the Tax Rates table.

The new Reduced Tax Rate will also need to be mapped to the accounts software tax code.

Importing Reduced Tax Rates into Products via CSV File

Reduced Tax Rates can be imported into products for individual countries using a simple CSV file that contains:

- SKU (ABC123)

- Country Code (DE)

- Tax Rate (129)

Tax Code by Country sample file (CSV)

Country codes can be found in the Countries table (Configuration > Organisation > Countries).

Tax Codes can be found in the first column of the Tax Rates Table (Configuration > Organisation > Countries). This is an internal Tradebox number.

To import reduced tax rates into products via a CSV file, go to the Product module and from the Actions button choose "Import Tax Codes Per Country". The CSV file should only contain a single country code and will need to be repeated for multiple country entries.

Comments

0 comments

Article is closed for comments.