How VAT on EU orders has changed

With effect from 01/07/2021 the responsibility for calculating, collecting, and remitting VAT on EU orders changed. This is based on a number of factors including the platform the order is sold on and the total value of the order. Generally, for sellers in England, Scotland and Wales, this can be broken down as follows:

Online Marketplaces (eBay, Amazon, Etsy, OnBuy etc):

- Where the order value does not exceed €150 the online marketplace (OMP) is responsible for calculating, collecting, and remitting the VAT to the destination country the order is being shipped to. Orders that meet this criteria would be accounted for as zero rated for VAT in your accounts software.

- Where the order value exceeds €150 the courier/shipping agent is responsible for calculating, collecting, and remitting the VAT to the destination country the order is being shipped to. Orders that meet this criteria would be accounted for as zero rated for VAT in your accounts software.

Direct Sales (websites):

- Where the order value does not exceed €150 AND the seller is IOSS registered, the seller is responsible for calculating, collecting, and remitting the VAT to the destination country the order is being shipped to. Orders that meet this criteria would be accounted for using the destination country's VAT levels in your accounts software.

- Where the order value exceeds €150 the courier/shipping agent is responsible for calculating, collecting, and remitting the VAT to the destination country the order is being shipped to. Orders that meet this criteria would be accounted for as zero rated for VAT in your accounts software.

For sellers based in Northern Ireland, which in effect remains part of the EU customs union, VAT will be due on sales shipped to the EU at the rate applicable in the destination country regardless of value.

Changes in Tradebox One V1.3

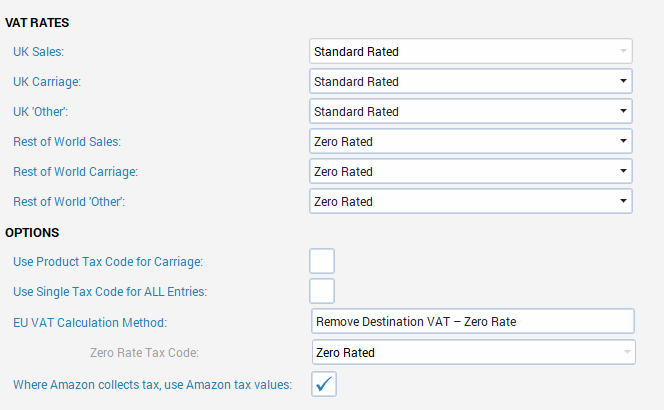

New controls have now been added to the VAT tab of each sales channel entitled, "EU VAT Calculation Method".

The options in the drop down box are:

- Remove Destination VAT - Zero Rated: This should be applied to channels that import orders from online marketplaces (OMP) such as eBay and Amazon. All orders imported with this method will be calculated as zero rated for VAT as the VAT on all EU orders from these channels will either have already been calculated, collected, and remitted by the OMP or will be collected by the courier/shipping agent. This option can also be used for all channels if you do not join the Import One Stop Shop (IOSS) scheme. If you import OMP orders via a CSV file you should choose this option ensuring that the CSV only contains OMP orders or that Tradebox is set to filter any direct sales out.

- Example 1: Product on sells on eBay for €119 and is being shipped to Germany. Tradebox will strip off the destination VAT (€19) that will be paid directly to the German VAT authorities by eBay and calculate the sale as €100. The order in Tradebox will be made up as Net value = €100, VAT = €0 and Gross value = €100. The tax rate used will be Zero Rated.

- Example 2: Product on sells on website for €119 and is being shipped to Germany. Tradebox will treat the Gross price as the Net price and calculate zero VAT. The order in Tradebox will be made up as Net value = €119, VAT = €0 and Gross value = €119. The tax rate used will Zero Rated.

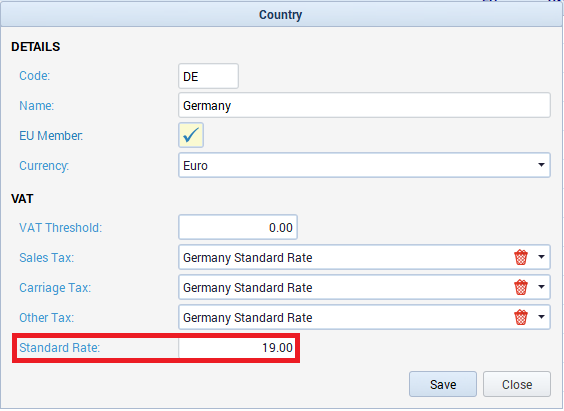

- Calculate Destination VAT on Orders Less than €150: This should be applied to channels where the seller is responsible for calculating, collecting, and remitting VAT on orders that do not exceed €150. Typically this will be direct sales through a webstore. The VAT will be calculated based upon the standard VAT rate held against the EU country the order is being shipped to in Configuration > Countries within Tradebox. If you sell products that have a zero VAT rate or 'reduced VAT rate' in a specific EU country these can be added in the Taxation tab of each product record. All EU orders in excess of €150 processed with this method will be zero rated for VAT as the responsibility to calculate, collect, and remit the VAT lies with the courier/shipping agent.

- Example 3: Product on sells on website for €119 and is being shipped to Germany. Tradebox calculates the VAT based on the destination country's standard tax rate. The order in Tradebox will be made up as Net value = €100, VAT = €19 and Gross value = €119. The tax rate used will be German Standard Rated.

- Example 4: Product on sells website for €238 and is being shipped to Germany. Tradebox will treat the Gross price as the Net price and calculate zero VAT. The order in Tradebox will be made up as Net value = €238, VAT = €0 and Gross value = €238. The tax rate used will Zero Rated.

- Calculate Destination VAT on all Orders: This option allows the user to apply the standard VAT rate held against the EU country the order is being shipped to in the Countries table, regardless of the value of the order. The VAT will be calculated based upon the standard VAT rate held against the EU country the order is being shipped to in Configuration > Countries within Tradebox. If you sell products that have a zero VAT rate or 'reduced VAT rate' in a specific EU country these can be added in the Taxation tab of each product record. This option is designed mainly for sellers based in Northern Ireland, who will need to continue remitting VAT on all sales shipped to the EU.

- Example 5: Product on sells on website for €238 and is being shipped to Germany. Tradebox calculates the VAT based on the destination country's standard tax rate. The order in Tradebox will be made up as Net value = €200, VAT = €38 and Gross value = €238. The tax rate used will be German Standard Rated.

- Zero Rate Gross Value (B2B): This option allows the user to simply treat the gross value of the order as Zero Rated. Typically this could be used were both the buyer and seller are based in the EU and are both VAT registered businesses.

- Example 6: Product on sells for gross price of €238 and is being shipped to Germany. Tradebox will treat the Gross price as the Net price and calculate zero VAT. The order in Tradebox will be made up as Net value = €238, VAT = €0 and Gross value = €238. The tax rate used will Zero Rated.

Where Amazon Collects Tax, Use Amazon Tax Values

The "Where Amazon Collects Tax, Use Amazon Tax Values" feature only appears in Amazon channels. If an order placed through Amazon is deemed to belong to the Import One Stop Shop (IOSS) scheme or the Union One Stop Shop (UOSS) scheme Amazon will mark the order as either IOSS or UOSS. In this scenario Amazon takes responsibility for calculating, collecting and remitting the VAT. If ticked, this feature will automatically strip the VAT Amazon specifies off the order and present it in Tradebox as zero rated. All orders that do not have an IOSS/UOSS flag will be calculated using the EU VAT Calculation method chosen for the channel.

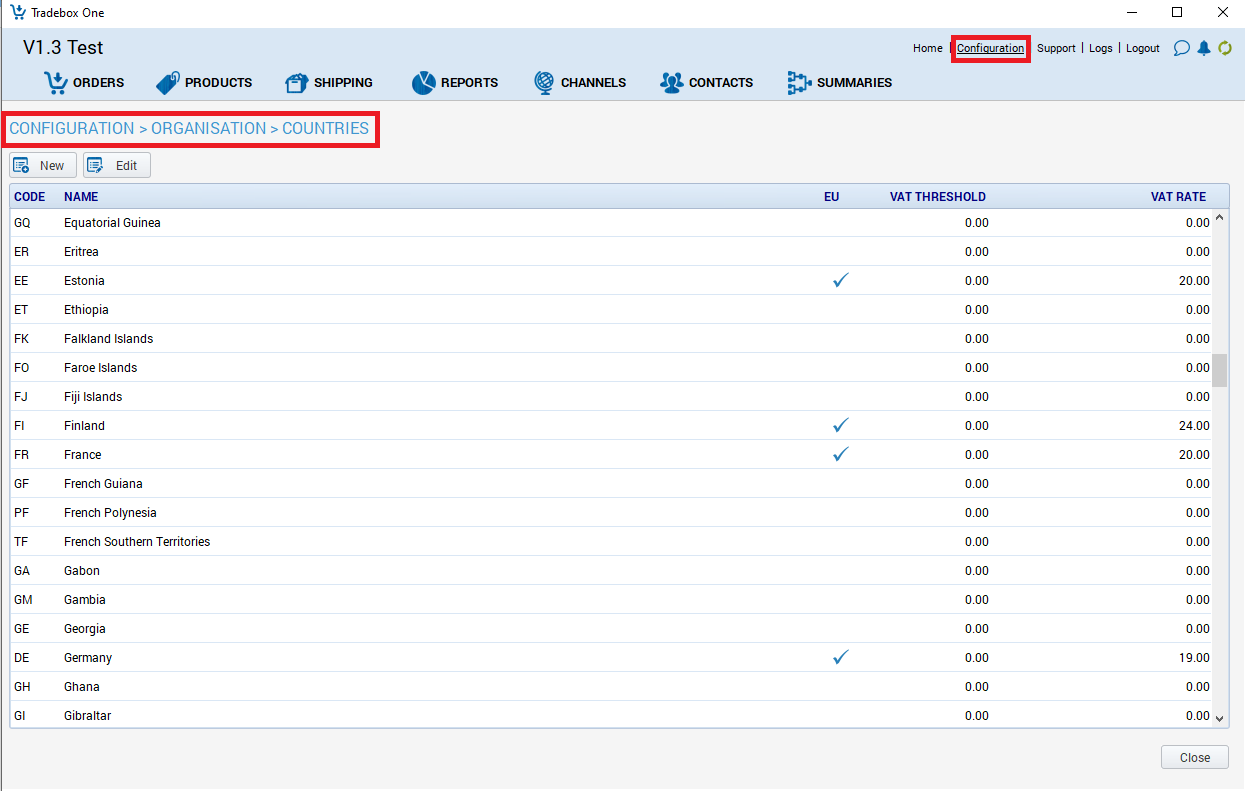

Countries Table

The Countries table (Configuration > Countries) now contains the Standard Rate of VAT charged by each EU member country. This value will be used to calculate VAT on orders being shipped to the EU where the EU VAT Calculation Method applied to a channel is either, "Calculate Destination VAT on Orders Less than €150" or "Calculate Destination VAT on all Orders".

Standard VAT Rates can be changed by double clicking into the country and changing the value in the Standard Rate box.

Tax Rates

The Tax Rates table (Configuration > Tax Rates) now contains the Standard Rate of VAT charged by each EU member country. This value will be used to calculate VAT on orders being shipped to the EU where the EU VAT Calculation Method applied to a channel is either, "Calculate Destination VAT on Orders Less than €150" or "Calculate Destination VAT on all Orders".

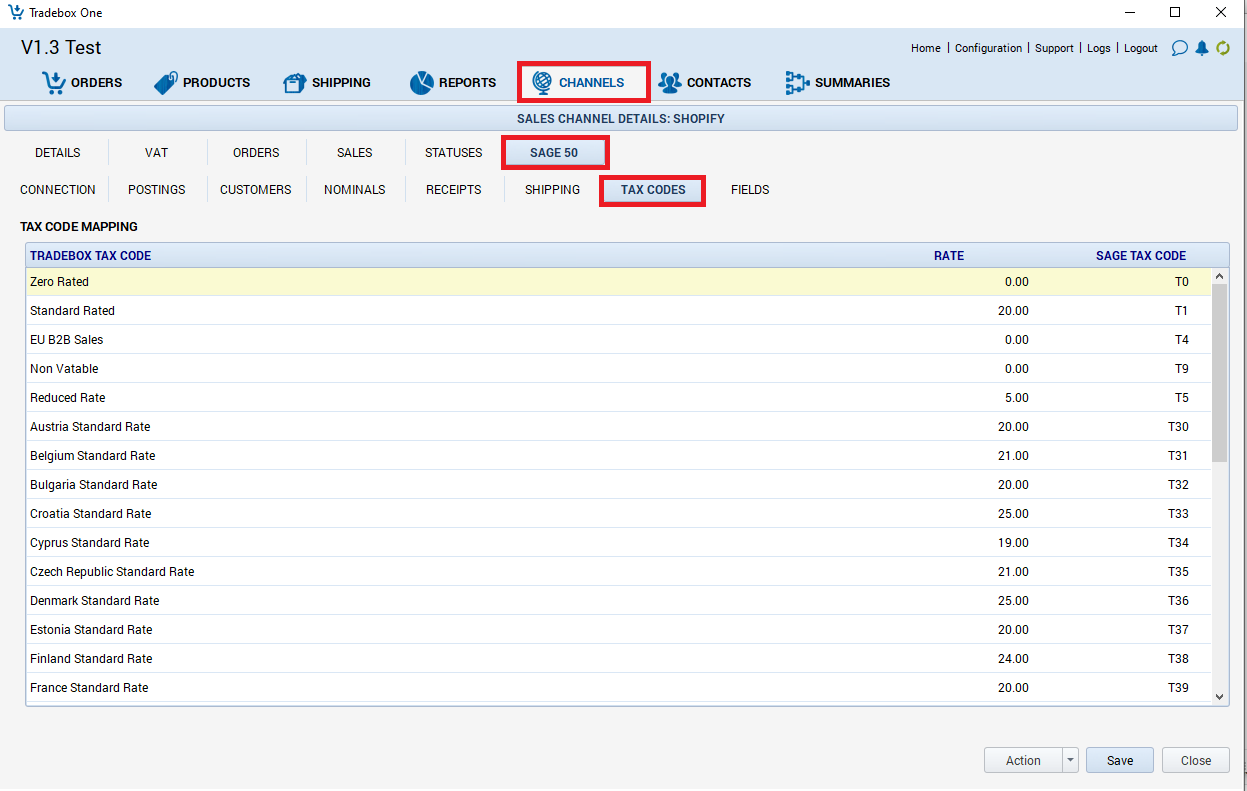

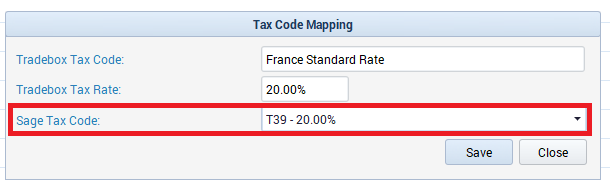

Tax Code Mapping

If you need to use the EU VAT Calculation Methods, "Calculate Destination VAT on Orders Less than €150" or "Calculate Destination VAT on all Orders" in a channel AND you have accounts integration set up, you will need to map the EU Tax code to the accounts software tax code. This is done in the accounts integration section of the channel settings under the Tax Codes (Sage) or Tax Rates (Xero) tab.

To do this double click on the tax code and select the accounts software tax code from the drop down list.

Once you have mapped all of your Tradebox EU tax codes to the corresponding Tax Code in your accounts software you can copy these to any other channels that you have set up as long as the other channel is pointing at the same accounts folder/company. To do this, from the Actions button in the Tax Codes screen choose Accounts Link > Tax Codes - Copy Mappings.

Zero Rated Products and Products with a Reduced Rate VAT

Where Tradebox is configured to calculate VAT on products being shipped to the EU, all products in the order will have the destination VAT rate applied to them. This includes products that may be zero rated for VAT or have a reduced rate of VAT in the UK. This is because a zero rated product in the UK isn't necessarily going to be zero rated in any of the 27 EU states.

If you sell products into the EU that have a zero or reduced VAT Rate for a specific country you will need to apply this to the product record. The VAT rate will need to be added to the Tax Rates Table and also be registered against the product itself.

Tax Codes can be added to individual products or this can be done in bulk by using a CSV import.

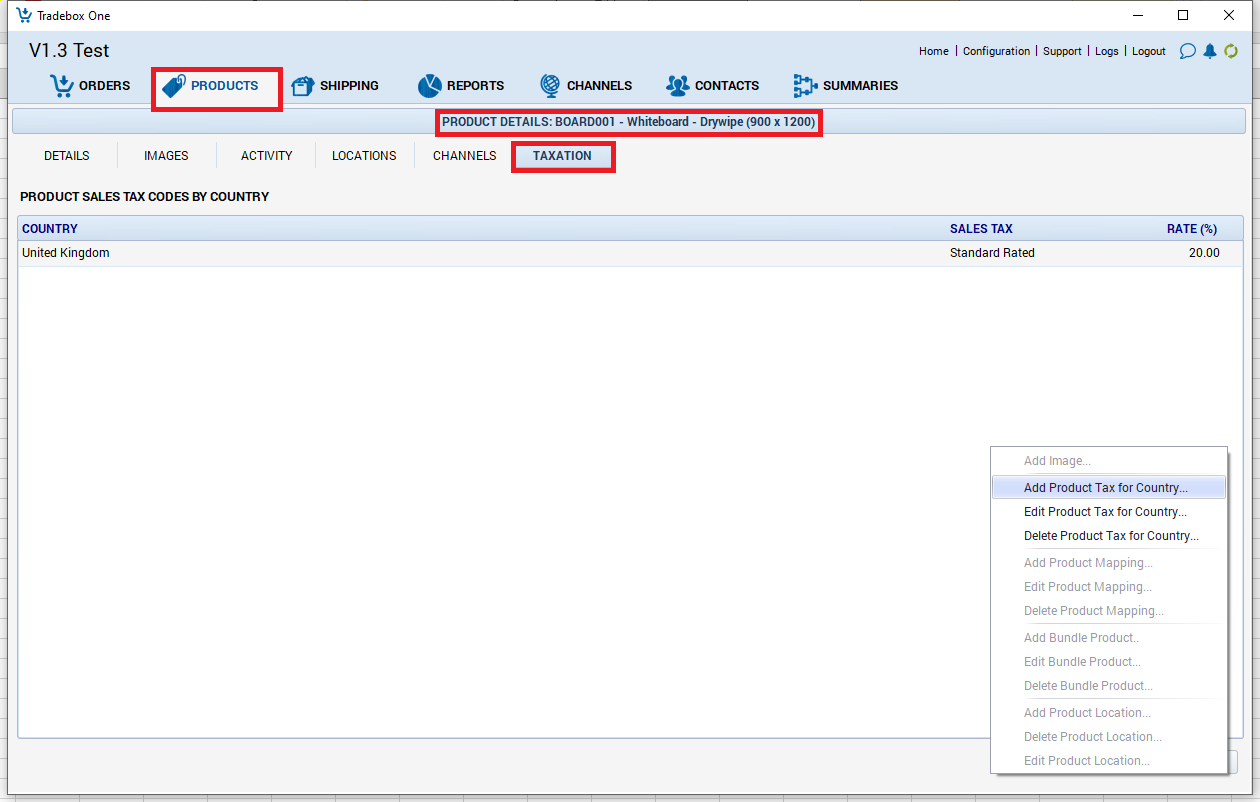

Adding Tax Codes to Products Individually

To add tax codes individually to products in Tradebox, go to the Products module and double click on the product then go to the Taxation Tab. From the Actions button at the bottom of the screen select Add Product Tax for Country:

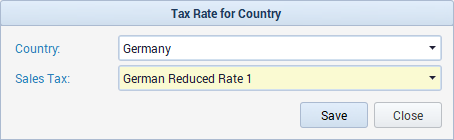

From the prompt box add the Country and the Reduced Tax Rate that has been created in the Tax Rates table.

The new Reduced Tax Rate will also need to be mapped to the accounts software tax code.

Importing Reduced Tax Rates into Products via CSV File

Reduced Tax Rates can be imported into products for individual countries using a simple CSV file that contains:

- SKU (ABC123)

- Country Code (DE)

- Tax Rate (129)

Tax Code by Country sample file (CSV)

Country codes can be found in the Countries table (Configuration > Organisation > Countries).

Tax Codes can be found in the first column of the Tax Rates Table (Configuration > Organisation > Countries). This is an internal Tradebox number.

To import reduced tax rates into products via a CSV file, go to the Product module and from the Actions button choose "Import Tax Codes Per Country". The CSV file should only contain a single country code and will need to be repeated for multiple country entries.

Comments

0 comments

Article is closed for comments.